[et_pb_section fb_built=”1″ _builder_version=”4.2.1″ custom_padding=”0px||||false|false”][et_pb_row column_structure=”1_2,1_2″ _builder_version=”4.2.1″ custom_padding=”0px||||false|false”][et_pb_column type=”1_2″ _builder_version=”4.2.1″ custom_padding=”|35px|||false|false” custom_padding_tablet=”|0px|||false|false” custom_padding_phone=”” custom_padding_last_edited=”on|desktop”][et_pb_text _builder_version=”4.2.1″]

As your clients look ahead to retirement, plans frequently center on family. The love between family members is a strong, enduring bond — the type of commitment that inspires us to put our loved ones first.

Today, many older Americans worry they’ll one day become a financial or emotional burden to the people they love most. If a client experiences a health event and requires long-term care (LTC) — and they have not prepared for this need — their family members could very likely become caregivers.

[/et_pb_text][et_pb_text _builder_version=”4.2.1″]

What is Long-Term Care Insurance?

LTC insurance is a way to reimburse clients for covered expenses they may need with care at home or in a facility when they are unable to do some of these basic daily activities of daily living (ADLs): bathing, dressing, eating, continence, toileting and transferring.

Asset-based LTC products are about helping clients be prepared and provide protections clients won’t get from other options.. That way, if care is needed, they can pay for those services or care so loved ones don’t have to provide the care or change their lifestyle to provide care.

[/et_pb_text][/et_pb_column][et_pb_column type=”1_2″ _builder_version=”4.2.1″][et_pb_text module_class=”cstGravForm” _builder_version=”4.2.1″ custom_margin=”-16px||||false|false” custom_margin_tablet=”0px||||false|false” custom_margin_phone=”” custom_margin_last_edited=”on|desktop” custom_padding=”||||false|false” hover_enabled=”0″]

We can help you design your next Long Term Care case

Call us @ (800) 846-3997 or complete the form below and we'll be contact you.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure=”1_2,1_2″ _builder_version=”4.2.1″ custom_margin=”||0px||false|false” custom_padding=”||0px||false|false”][et_pb_column type=”1_2″ _builder_version=”4.2.1″ background_color=”#f9f9f9″ custom_padding=”20px|5px|20px|20px|false|false”][et_pb_text module_class=”listContent” _builder_version=”4.2.1″ header_2_font=”Nunito||||||||” header_2_font_size=”30px” header_3_font=”Nunito||||||||” header_3_font_size=”26px”]

Consumer Brochures

[/et_pb_text][/et_pb_column][et_pb_column type=”1_2″ _builder_version=”4.2.1″ background_color=”#f9f9f9″ custom_padding=”20px|5px|20px|20px|false|false”][et_pb_text module_class=”listContent” _builder_version=”4.2.1″ header_2_font=”Nunito||||||||” header_2_font_size=”30px” header_3_font=”Nunito||||||||” header_3_font_size=”26px”]

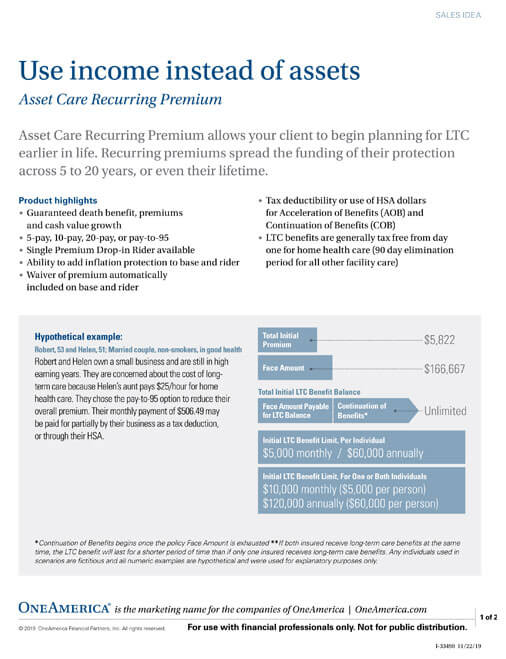

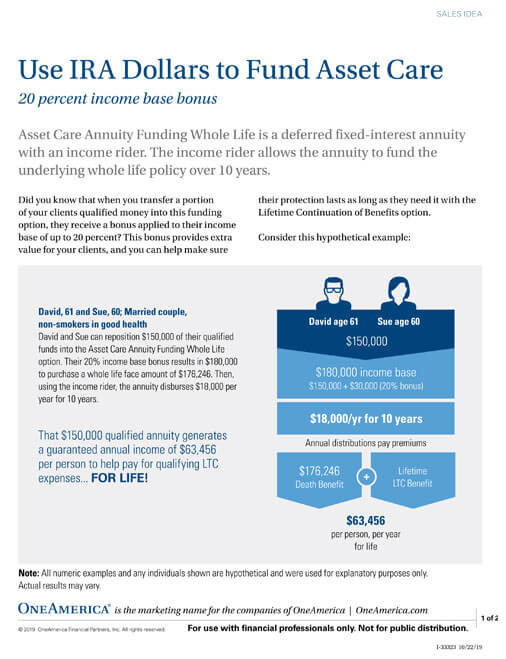

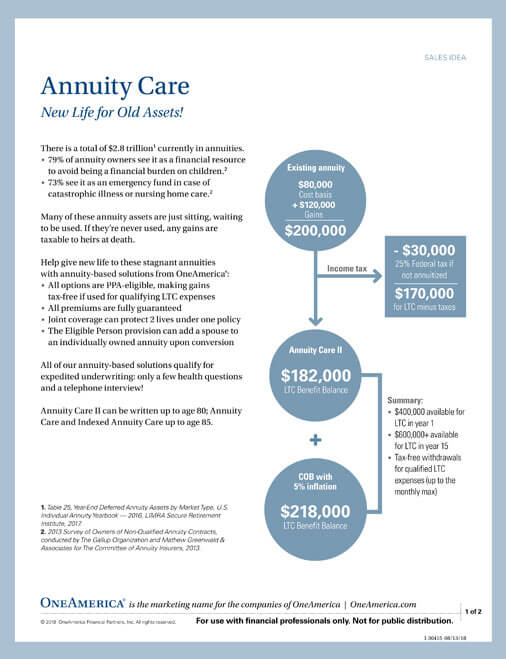

Sales Ideas:

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”4.2.1″ custom_margin=”||||false|false” custom_padding=”0px||||false|false”][et_pb_row column_structure=”1_5,3_5,1_5″ _builder_version=”4.2.1″][et_pb_column type=”1_5″ _builder_version=”4.2.1″][/et_pb_column][et_pb_column type=”3_5″ _builder_version=”4.2.1″][/et_pb_column][et_pb_column type=”1_5″ _builder_version=”4.2.1″][/et_pb_column][/et_pb_row][/et_pb_section]