The current Guaranteed UL market is tumultuous to say the least right now. Everyone in our industry speaks to the “continued historic low interest rate environment”, and of course, they’re right. However, the fact remains that there are still options out there for low cost guarantees on permanent insurance to solve current (and likely even greater, future) estate planning problems. Indexed UL doesn’t have the same requirements as their GUL counterparts, and thus our carrier friends can offer lower premiums for equal death benefits.

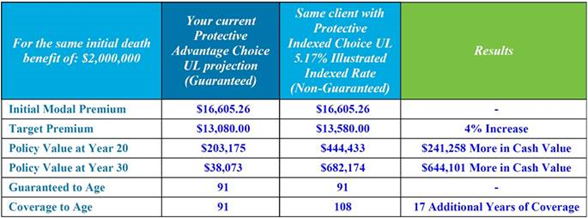

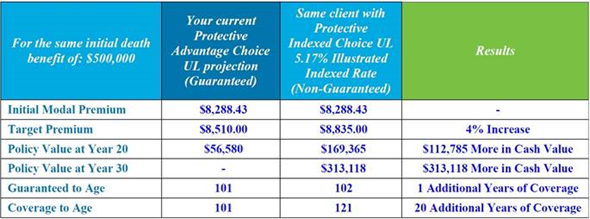

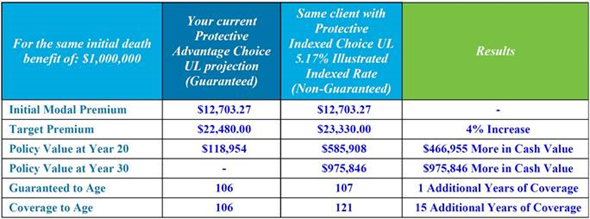

Immediately though you think “but my client needs the guarantee in death benefit afforded by a GUL!” I’m amazed at the number of conversations I have with advisors that are unaware that IUL’s, specifically protection style IUL’s, offer guarantees to age 90, 95, 100 or beyond! Not only can we offer a death benefit guarantee to age 95, but we also have the advantage of indexing that can provide substantial cash value when designed correctly, often requiring less premium than its GUL cousin. The best of both worlds! The GUL, which still has its place in the planning world, continues to struggle. And yes… this is due to the longevity of the low interest rate environment that we currently experience.

There will always be a place and a need for guaranteed death benefit policies. As carriers providing traditional GUL policies continue to increase rates due to the hardship of the unforeseen, prolonged suffering of their general accounts because of the historic low interest rate environment, there do remain a few that stand out amongst the rest. There are still products to be found that are positioned to take advantage of this need and continue to rise to the top, even in an uncertain world.

Whether your client is looking for a single pay, short pay or 1035 scenarios, one carrier comes to mind immediately. Protective’s Lifetime Assurance UL and Advantage Choice UL are uniquely positioned in the GUL/GIUL space still to help these clients! And remember, IUL with no-lapse guarantees, offer both the protection of a GUL as well as the potential cash accumulation of an IUL with higher target premiums! Have your cake and eat it too!!!

Let’s take a look at some Protective examples.

Level Pay Design

Male Age 55 Standard Non-Tobacco, $500k DB, Guaranteed thru Age 100

1035 Exchange Design

Female Age 65 Standard Non-Tobacco, $1M DB, $200k 1035 Exchange, Guaranteed thru A105

Short Pay Design

Female Age 45 Select Preferred Non-Tobacco, $1M DB, Pay to Age 65, Guarantee thru Age 90