“The potentially catastrophic consequences of becoming disabled and needing long-term care is arguably the gravest financial risk that older adults face.” -Favreault & Johnson, Microsimulation Analysis of Financing Options for Long-Term Services and Supports

Insurance professionals at their best fuse their robust knowledge of products with their understanding of their client’s life-needs to craft a form-fitting policy that truly works. Insurance professionals are comfortable talking about life, death, and misfortune while helping their clients embrace the risk so that they can set themselves up for any outcome. Of all of life’s possible mishaps, none pose a greater financial risk than the need for long term care. Long Term Care Insurance is a very flexible and complex product. When designing the best policy for your client’s unique needs, we advise you to contact the experts at the Rocky Mountain Insurance Networks for guidance. Their devotion to serving insurance producers and their extensive knowledge of LTC insurance will help you navigate and design the most beneficial policies for your clients.

A Fiduciary Responsibility to Your Client

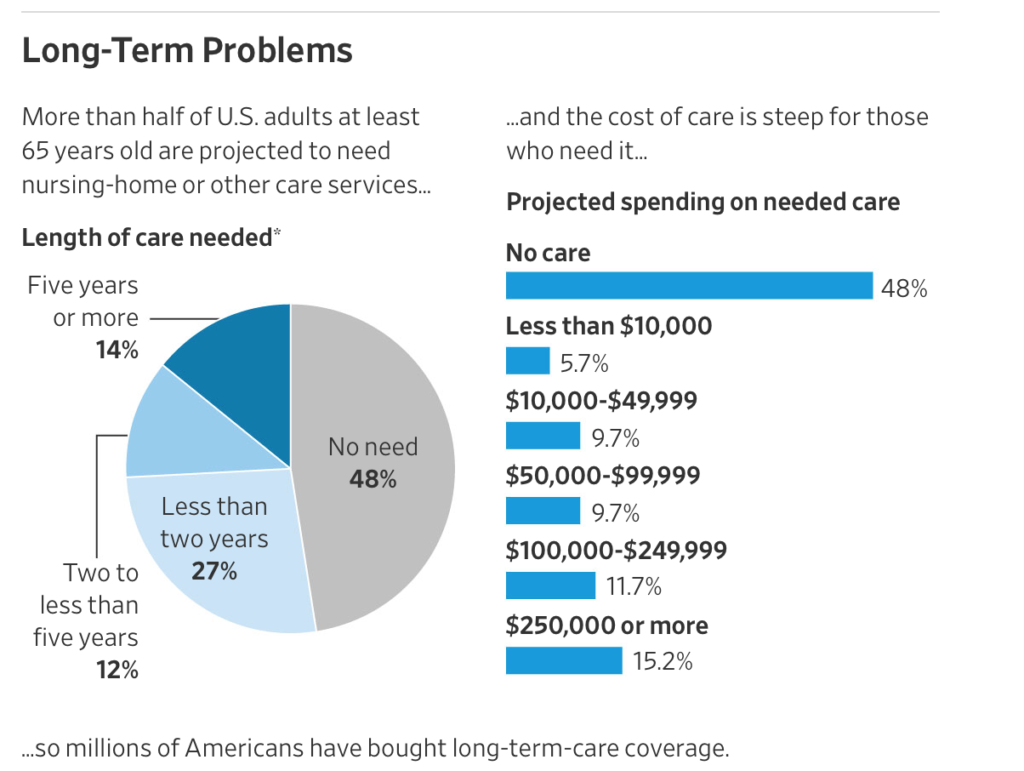

Your client has been saving up for their retirement for years. They have been investing in the market, contributing to their 401K, purchasing life insurance, and working hard for their families. However hard they have worked and saved, illnesses and misfortune can bankrupt their retirement in just a handful of years. It is estimated that 52% of people turning age 65 will require long-term care services at some point in their lifetimes. With the median annual cost of a nursing home facility at $95,775 dollars, even savings and assets with excellent growth will be depleted faster than they can be replenished. For these reasons, we believe that it is every insurance producer’s fiduciary responsibility to discuss long term care insurance with their clients.

When it comes to actually paying for long term care, your client has 4 options:

- Pay for long term care out of pocket. (19% of patients and their families shoulder this burden)

- Rely on friends and family members to provide care. (34 million Americans supplied unpaid care to adults over 50 in the past year)

- Pay for long term care insurance out of pocket

- Utilize existing assets to cover the cost of long term care insurance (such as life insurance and 401K using a 1035 exchange)

Dealing with the costs associated with a tragic life event or development that requires a long term care solution could be the most important financial decision your client ever has to make. From the list above, paying for your care out of pocket can quickly consume your client’s bank account and assets. Assuming a 4% decumulation rate of assets in retirement and a 9% additional decumulation due to long term care expenses, the loss will negatively outgain the rate of return. In an example where a client has 1 million dollars in assets with an average 9% return, the event of adding long term care would deplete the assets within 10 years. Essentially, the care itself effectively negates the gain and the client’s other expenses drain the assets. This is an unacceptable and tragic loss of everything your client has been working for their entire careers.

Unpaid Family Care: The Invisible Burden

The strength of family caregivers in the United States is heroic and noble. However, relying on family is not only limited in terms of medical expertise and best practices, but also sustains an enormous burden on the part of the caregiver. Late in our lives, the last thing we want to be on our loved ones is a burden. Statistics show that 70% of family and friend caregivers suffered work-related challenges because of the time spent caring for their sick loved ones. Additionally, over one-third of these caregivers experienced devastating financial strain. This is not the legacy that your clients want to leave for their children. Insurance that can balance the risk of this burden is not only responsible, but merciful during an already difficult experience.

Out of Pocket Long Term Care Insurance

Paying for Long Term Care Insurance out of pocket is a wise thing to do…if your client can afford it. A typical policy for 6 years of long term care that pays $7,000 dollars per month (once the claim has been established) and provides a payout in the case of death (should no long term care be needed) of around $140,000 can be purchased for a little over $70,000 in a one-time payment. This is far less than the average single-year cost of a room in a nursing home facility. On average, men and women will spend 1.5 years and 2.5 years in a long term care scenario respectively. It immediately becomes obvious that purchasing insurance is the most prudent decision in order to protect their assets from annihilation. But what about people who can’t afford to pay in cash?

Asset-based Long Term Care Insurance: The New Standard

Of all of the options to solve the long term care payment puzzle, asset-based long term care insurance is by far the most flexible and least painful way to ensure that your clients are taken care of should the need arise as they age.

By leveraging assets which they have already paid into, your client is able to create a safety net for their old age without robbing their retirement to do so. Purchasing long term care insurance through the transfer of a life insurance policy accrues no penalties of tax burdens while maintaining liquidity. Purchasing the insurance ignores pre-existing conditions and often does not require a medical exam. Many policies allow for the client to cash out their LTC insurance at a slight loss should they need the money for something else. Additional riders can be added (for additional cost) to extend care or to account for inflation of the price of care over time. For reference, between 2016 and 2017 the rate for a room at a nursing home rose 5.5 % and current prices look to continue that trend.

Additionally, clients can leverage their 401K to cover the cost of LTC insurance. From a tax perspective, this asset approach to obtaining coverage differs in that it uses pre-taxed money from a 401K. This means that the initial amount withdrawn to cover the policy will be taxed over time (20 years). However, advantages baked into the Pension Protection Act further reduce the tax burden of this approach.

Be a Compassionate Insurance Advisor

As an insurance advisor who cares about your clients, the necessity of long term insurance grows with each passing year. Traditional long term care insurance and asset-based long term care insurance offers quality care for when they are most vulnerable. It is invaluable in preserving their dignity, their family’s well being, and their security while acting as a seawall that buffers their assets and their legacy in the event of a high watermark. Your job as their advisor is to safeguard them from any eventuality, our job is to provide you with industry-leading experts on the complexities of LTC insurance that will help you craft a winning policy for your client. Speak with one of the many dedicated professionals at Rocky Mountain Insurance Network for assistance and make LTC insurance a part of your client offering.

Given the stark statistics that dominate the financial landscape of long term care expenses, adding long term care insurance to your client’s policy portfolio will offer protection when they need it most. Your client relies on you to guide them safely through a sea of risk and wild unknowns. Do right by them and defend their future with long term care insurance.